Will Surging Crypto Prices Damper Interest in AI?

Will the recent crypto boom affect the pace of AI innovation?

In 2016, when I bought my first CUDA-capable card, the world of general-purpose GPU programming was split into two main fields: the deep learning nerds and the crypto geeks. I was firmly in the former category, but it felt like both communities were similarly vibrant.

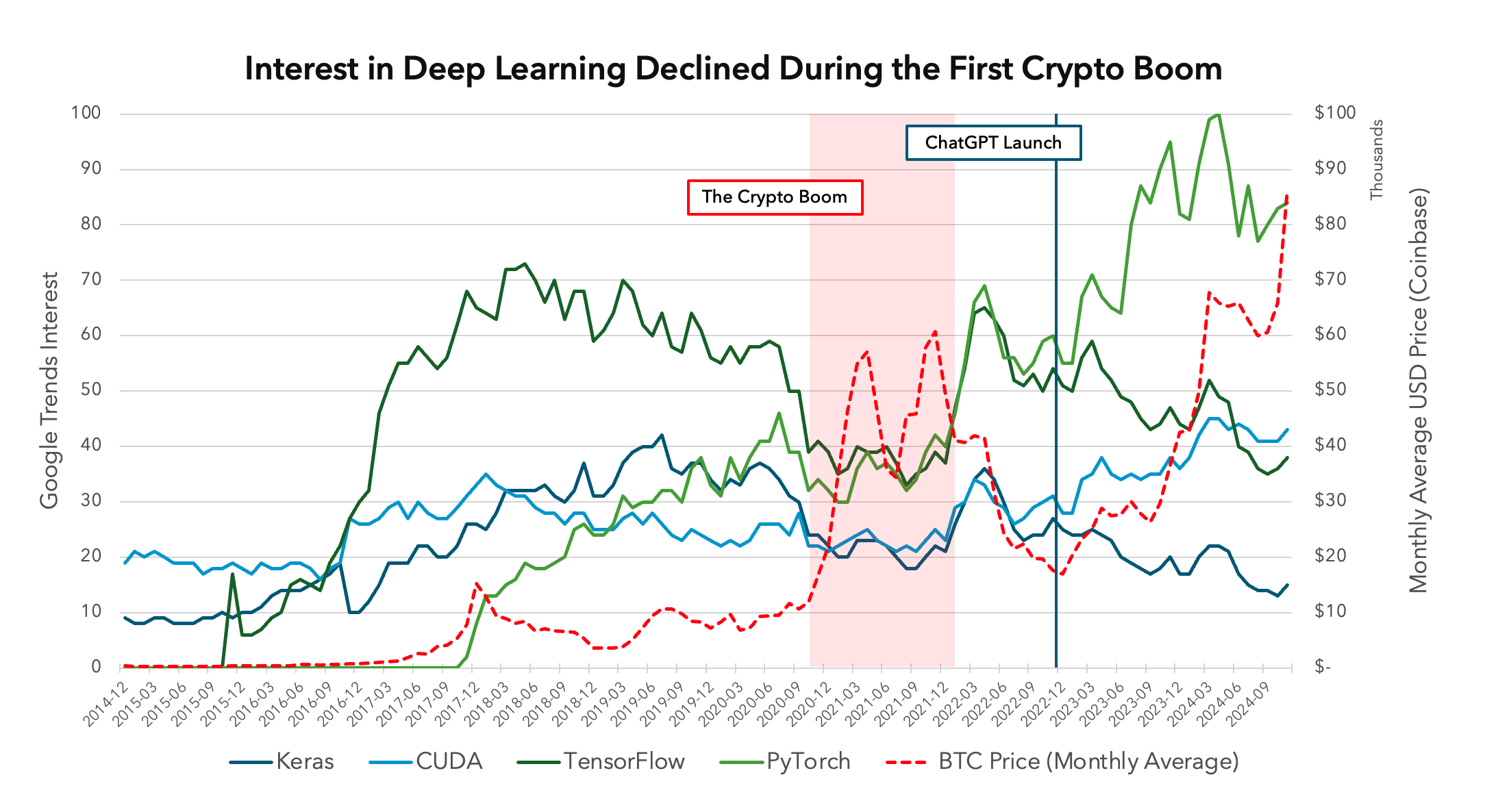

But from the end of 2020 to the beginning of 2022, crypto won out. Bitcoin and Etherium prices skyrocketed, after stringing together over a year of ~$10k BTC prices. Nerd interest shifted – which we can clearly see in the Google Trends data. During the boom, search volumes for deep learning libraries like TensorFlow, Keras, and PyTorch plummeted.

The deep learning community lost the tourists, who were now using their CUDA cores to mine whatever coin made sense that day.

When prices fell back to earth, interest in higher-level deep learning libraries resumed their prior trajectory. CUDA and PyTorch (the clear winner in higher-level libraries these days) snapped upwards following OpenAI’s ChatGPT’s launch, kicking off a tsunami of interest and investment in deep learning AI.

Which brings us to today: BTC prices are at all-time highs, besting their levels during the first boom. Will this steal resources from the AI ecosystem? Will it become harder to find AI talent, harder to fund new AI applications – resources AI needs now as they look for ways to get past the wall models are hitting?

AI’s in a different place than it was in 2020, but ~$100k BTC is difficult to ignore for many…

If there’s an upside to surging crypto prices, it’s that we’ll see the loudest hype-men1 ditch their AI beats and focus on the coin(s) of the moment. Maybe Sober AI will become the dominant conversation and we can make some quiet headway for a few years, albeit with less investment.

-

The gendering is very intentional here. ↩